International Monetary

Fund chief Kristalina Georgieva has said that risks to

financial stability have increased and called for continued

vigilance although actions by advanced economies have calmed

market stress.

The IMF managing director reiterated on Sunday her view that 2023

would be another challenging year, with global growth slowing to

below 3 percent due to scarring from the pandemic, the war in Ukraine

and monetary tightening.

Even with a better outlook for 2024, global growth will

remain well below its historic average of 3.8 percent and the overall

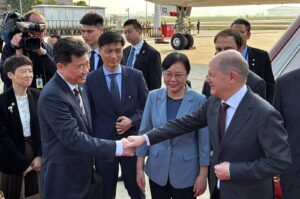

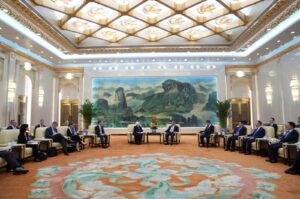

outlook remained weak, she said at the China Development Forum.

The IMF, which has predicted global growth of 2.9 percent this

year, is slated to release new forecasts next month.

Georgieva said policymakers in advanced economies had

responded decisively to financial stability risks in the wake of

bank collapses but even so vigilance was needed.

“So, we continue to monitor developments closely and are

assessing potential implications for the global economic outlook

and global financial stability,” she said, adding that the IMF

was paying close attention to the most vulnerable countries,

particularly low-income countries with high levels of debt.

She also warned that geo-economic fragmentation could split

the world into rival economic blocs, resulting in “a dangerous

division that would leave everyone poorer and less secure.”

READ MORE:

What’s causing the Credit Suisse scare and the drop in global stocks?

China’s economic rebound

Georgieva said China’s strong economic rebound, with

projected GDP growth of 5.2 percent in 2023, offered some hope for the

world economy, with China expected to account for around one-third of global growth in 2023.

The IMF estimates that every 1 percentage point increase in

GDP growth in China results in a 0.3 percentage point rise in

growth in other Asian economies, she said.

She urged policymakers in China to work to raise

productivity and rebalance the economy away from investment and

towards more durable consumption-driven growth, including

through market-oriented reforms to level the playing field

between the private sector and state-owned enterprises.

Such reforms could lift real GDP by as much as 2.5 percent by 2027,

and by around 18 percent by 2037, Georgieva said.

She said rebalancing China’s economy would also help Beijing

reach its climate goals, since moving to consumption-led growth

would cool energy demand, reducing emissions and easing energy

security pressures.

Doing so, she said, could reduce carbon dioxide emissions by 15 percent over the next 30 years, resulting in a fall in global emissions of 4.5 percent over the same period.

READ MORE:

Global economy to face more pain in 2023 – experts

Be First to Comment