Japan is stepping up efforts toward issuing a digital yen with the creation of a government advisory panel and the launch of a pilot programme, joining a growing number of countries exploring a central bank digital currency (CBDC).

The finance ministry will set up a panel of experts as early as April to discuss the feasibility of issuing a digital yen, Reuters reported on Friday citing two sources with knowledge of the matter.

The step will come after the central bank’s decision to start in April a pilot programme to test the use of a digital yen, moving Japan closer to issuing a CBDC in several years.

Under a medium-term policy platform issued in 2021, the government pledged to start examining the feasibility of a CBDC when the Bank of Japan (BOJ) completed the initial phase of experiments by March 2023, which it has.

“It will be in line with the pledge made in the policy platform,” one of the sources said on the plan to set up a government panel, a view echoed by the other source.

Both sources declined to be identified as they are not authorised to speak publicly.

Finance Minister Shunichi Suzuki told reporters on Friday the government was still in the process of scrutinising ways to meet the pledge to examine the feasibility of a CBDC, including the idea of the panel.

The BOJ has said no decision has been made on whether Japan will issue a CBDC.

But it spent two years experimenting and will move to the next phase of conducting a pilot programme from April, to be ready in case the government decides to issue a digital yen.

READ MORE:

Facebook ready to launch ‘Novi’ digital wallet

Pilot test

The central bank has said the pilot programme may last for several years. Some laws may need to be revised if the government were to start issuing a CBDC for public use.

“Ensuring the coexistence of CBDC with various other forms of money … is something that we need to and will in fact achieve in the future,” BOJ Governor Haruhiko Kuroda said in a speech on Tuesday.

Public broadcaster NHK reported on Thursday the finance ministry was considering setting up an advisory panel in April to discuss the possibility of a digital yen.

Central banks around the world have stepped up efforts to develop digital currencies to modernise financial systems and speed up domestic and international payments.

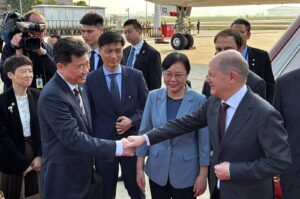

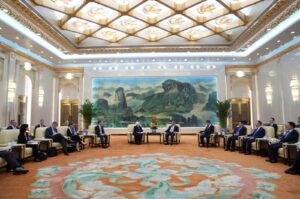

Japan and other advanced economies are seeking to catch up with China, which is at the fore of a global race to develop CBDCs and has ramped up pilot schemes for retail payments.

The US Federal Reserve has also been exploring a fully digital dollar that some have referred to as Fedcoin.

Fed leaders have said that any launch of such an asset would need the support of elected leaders.

READ MORE:

Central banks explore their own units as bitcoin popularity soars

Be First to Comment